Category: Personal Finance

In Defense of No-Spend Months

Why do we need a No-Spend month? Well, two months ago my family and I experienced a fantastic couple of weeks vacationing, traveling with friends, vacations-within-the-vacation, adventures, visiting exotic locals and enjoying delicious restaurants, sometimes with friends. It was an absolute blast, making memories that we hope will last us a lifetime. But then came…

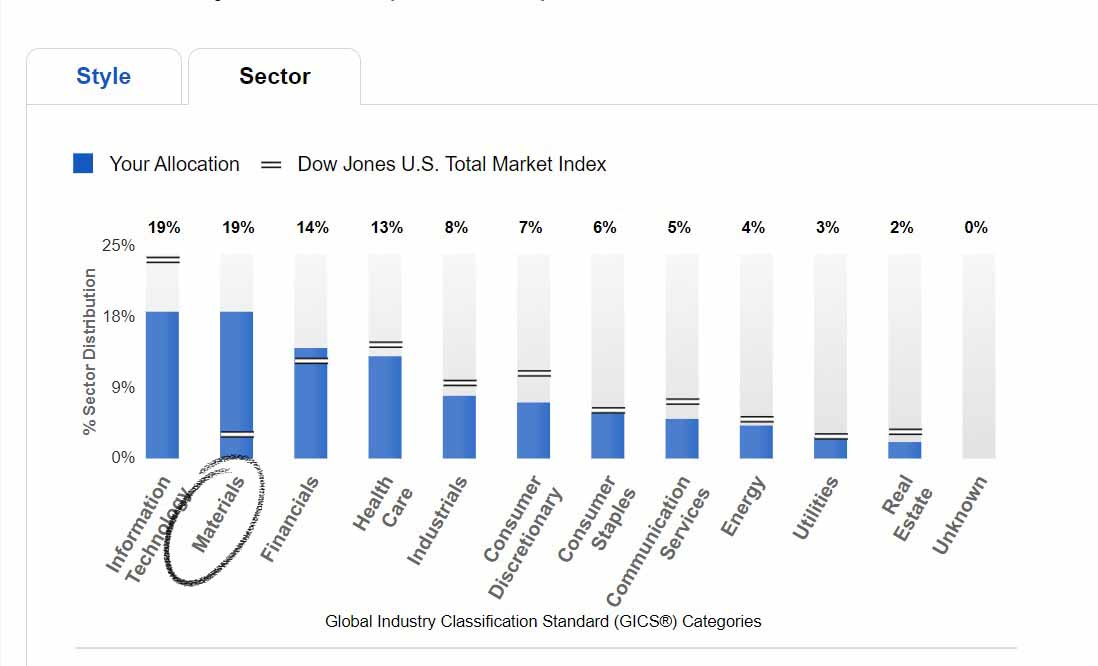

Portfolio Rebalancing in 2023

Assessing Investment Portfolio Health – What’s in Your Portfolio? It is commonly accepted wisdom that a “balanced” investment protfolio is a key part of managing your investments. By having an balanced portfolio, you spread your risk around to different types of investments, while also giving yourself the oppurtunity to benefit if and when there is…

Notion’s Superpower? Clarity through Simplification

One of the most common refrains that that people don’t “get” Notion until it changes their lives. Then people love it. The make free templates for the community. They make video after video on the tips and tricks of Notion. But many people are missing Notion’s super-power, which in my opinion, is clarity through simplification….

Starting to Think About Investing and Retirement

So you’re starting to think about investing and retirement – well, I hope you’re ready for a lot of confusing lingo, math formulas with lots of Greek symbols, and a healthy pile of shame (why did you wait soooo long to start to invest, and also at the same time, who do you think you…

Living in Dangerous Abundance

We seem to be physiologically wired for danger, difficulty and adversity. And we seem to be emotionally hardwired for community. We also seem to be spiritually hardwired for a connection to the supernatural. But we also have this inclination to adapt to our circumstances, and to assume that life will continue along its normal path…

Timely Points from the Little Book of Sideways Markets

I like little books. The Little Book of Common Sense Investing (by John Bogle). The Little Book that Beat the Market (by Joel Greenblatt and Andrew Tobias). How to Retire with Enough Money (by Teresa Ghilarducci). In the Little Book of Sideways Markets (by Vitaliy N. Katsenelson) the premise is concise: After an extended bull…

Kakeibo – A Simple Money Saving Method

One of the things that I’m trying to do this month is to use a “Kakeibo” ledger to track our household expenses. Holidays, vacations, Christmas, travel, birthdays all hit this time of year in my household, so taking January to reorient (and recover) our household financial state helps us set goals for the upcoming year…

Expect the Unexpected

The world is a messy place, and despite our best efforts to control that mess, things will go wrong and you will not be able it any more than you are able to block an eight-foot tall wave from knocking you to the ground. Where I see this play out is in people’s finances…

Daily Choices made Daily

Seth Godin recently had a episode called “Paul has a Practice” – about how Paul McCartney had a creative process and rhythm. Really well done podcast – succinct, thought provoking and engaging. One of Seth’s points near the end was the idea that he’s a fan of the daily blog model because it eliminates one…